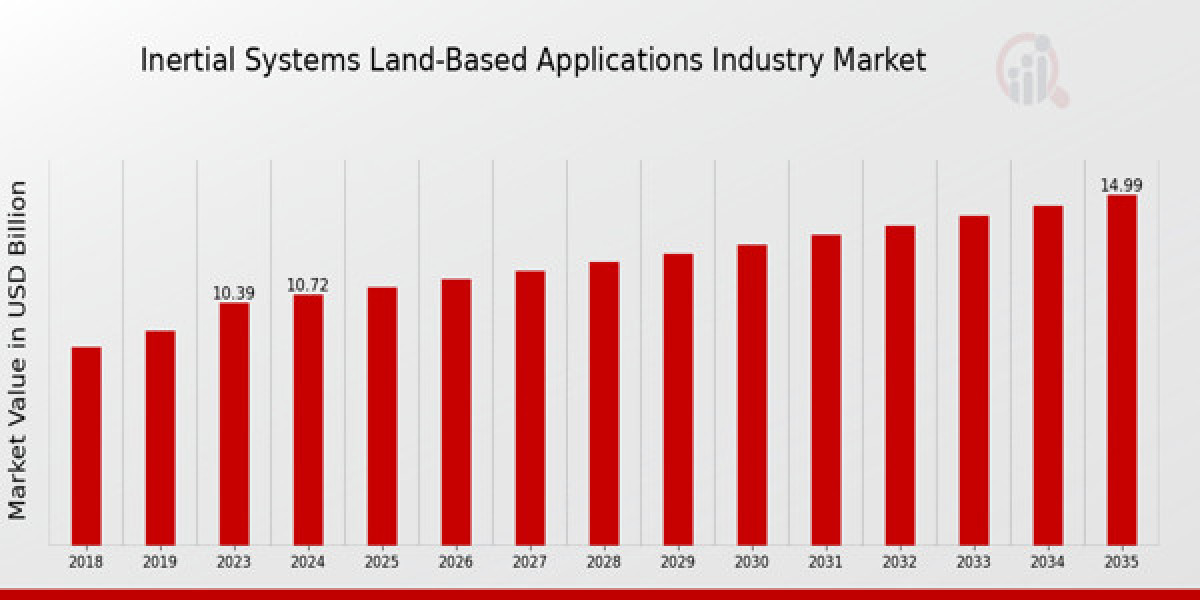

Inertial Systems Land-Based Applications Market Overview

The Inertial Systems Land-Based Applications Market is experiencing steady growth as demand rises across defense, transportation, agriculture, construction, and industrial automation sectors. Inertial systems — which include components like accelerometers, gyroscopes, and inertial measurement units (IMUs) — are vital for accurately measuring motion, orientation, and velocity. These systems have become essential for navigation in GPS-denied environments, enhancing autonomous mobility, safety, and system performance.

Inertial systems are particularly critical in land-based applications such as autonomous vehicles, precision farming, robotics, and military vehicles. Technological advancements, such as the integration of micro-electromechanical systems (MEMS) and the development of AI-driven inertial navigation systems, are significantly boosting market growth.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/43818

Key Market Segments

The market for inertial systems used in land-based applications can be segmented based on:

1. Component Type

Accelerometers

Gyroscopes

Inertial Measurement Units (IMUs)

Inertial Navigation Systems (INS)

Attitude and Heading Reference Systems (AHRS)

2. Technology

Mechanical

Ring Laser Gyroscope (RLG)

Fiber Optic Gyroscope (FOG)

Micro-Electromechanical Systems (MEMS)

Vibrating Structure Gyroscope (VSG)

3. Application

Military and Defense: Used in tanks, missile systems, and troop transport vehicles.

Agriculture: Supports precision farming through real-time data on terrain and motion.

Automotive and Transportation: Enhances safety and accuracy in advanced driver-assistance systems (ADAS) and autonomous vehicles.

Construction and Mining Equipment: Improves navigation and operational efficiency.

Industrial Robotics: Used in automated guided vehicles (AGVs) and robotic arms for navigation and positioning.

4. End Users

Government and Defense Agencies

Agricultural Operators

Logistics and Transport Companies

Construction Firms

OEMs (Original Equipment Manufacturers)

Industry Latest News

The inertial systems landscape is evolving quickly with major technological breakthroughs, strategic collaborations, and mergers and acquisitions shaping the future of the market:

March 2025: Honeywell unveiled its next-generation MEMS-based IMUs designed specifically for rugged land-based military and robotic applications. These units offer higher sensitivity and lower drift over time.

January 2025: Northrop Grumman and the U.S. Army signed a $150 million contract to develop high-accuracy inertial navigation systems for off-road autonomous military vehicles.

December 2024: Bosch expanded its production capacity for MEMS-based inertial sensors to meet the increasing demand from electric and autonomous vehicle manufacturers.

October 2024: NovAtel launched its new SPAN GNSS+INS solution, integrating FOG-based IMUs with advanced GNSS systems, targeting agricultural and industrial automation applications.

These developments highlight the critical role of R&D and innovation in advancing inertial system performance and reliability.

Key Companies

Several key players dominate the Inertial Systems Land-Based Applications Market, focusing on high-performance and miniaturized systems:

Honeywell International Inc.

One of the leading providers of high-precision IMUs and gyroscopes for military and commercial land systems.

Northrop Grumman Corporation

Specializes in navigation-grade inertial systems for defense and autonomous vehicles.

Thales Group

Offers advanced inertial navigation technologies with applications in military, construction, and mining.

Bosch Sensortec

A pioneer in MEMS technology, serving automotive and industrial sectors.

Analog Devices, Inc.

Known for its compact, power-efficient inertial sensors, widely used in land robotics and transportation.

KVH Industries

Manufactures FOG-based navigation systems primarily for autonomous vehicles and military ground systems.

Trimble Inc.

Focuses on GNSS-INS integration for agricultural, construction, and logistics applications.

Safran Group

Delivers robust inertial solutions tailored for land defense and industrial equipment.

These companies are actively investing in AI-enabled navigation, sensor fusion, and machine learning algorithms to enhance system accuracy in dynamic environments.

Market Drivers

The growth of the inertial systems market in land-based applications is driven by several factors:

1. Rise of Autonomous Vehicles and Robotics

The surge in autonomous ground vehicles, including self-driving cars, drones, and agricultural machinery, is creating robust demand for reliable inertial navigation systems, especially where GPS signals may be intermittent or unreliable.

2. Defense Modernization Initiatives

Governments worldwide are investing in modernizing their defense fleets with AI-powered navigation systems, driving demand for advanced inertial solutions in tanks, military trucks, and unmanned ground vehicles (UGVs).

3. Precision Agriculture

Farmers are increasingly adopting precision agriculture tools powered by inertial sensors to improve efficiency, yield, and sustainability.

4. Industrial Automation and Smart Construction

The integration of inertial systems in construction and mining vehicles enables real-time terrain mapping, accurate drilling, and better positioning of equipment in complex land environments.

5. Technological Advancements

The development of compact, low-cost MEMS sensors and hybrid systems combining inertial, GPS, and vision-based systems are expanding the scope and scalability of land-based inertial systems.

6. Regulatory Push for Safety and Efficiency

Regulations mandating better vehicle safety and operational efficiency, particularly in the transportation and logistics sectors, are increasing the adoption of inertial systems.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/inertial-systems-land-based-applications-market-43818

Regional Insights

North America

North America, particularly the United States, leads the global market due to massive defense spending, widespread adoption of autonomous systems, and active R&D efforts. The presence of key players like Northrop Grumman, Honeywell, and Trimble further boosts regional dominance.

Europe

Europe follows closely, with strong demand from military programs, automotive OEMs, and industrial automation. Countries like Germany, France, and the UK are investing heavily in precision navigation technologies.

Asia-Pacific

The Asia-Pacific region is projected to witness the highest CAGR, driven by booming construction activities, rapid urbanization, and large-scale adoption of smart agriculture, especially in China, India, and Japan.

Middle East & Africa

This region shows promise with increased defense budgets and infrastructure development, especially in the UAE and Saudi Arabia.

Latin America

Growing mining and agricultural activities in countries like Brazil and Chile are gradually increasing the demand for rugged land-based inertial systems.

Conclusion

The Inertial Systems Land-Based Applications Market is set to transform the landscape of navigation and automation in land vehicles, robotics, agriculture, and defense. With rapid advancements in MEMS technology, AI integration, and strategic partnerships across the globe, the market promises strong growth and innovation opportunities. Key stakeholders are advised to invest in R&D and collaborate across industries to unlock the full potential of inertial systems in the evolving land mobility ecosystem.