Passive Optical Network Equipment Market Overview

The Passive Optical Network (PON) equipment market has experienced significant growth in recent years, driven by the increasing demand for high-speed internet and the expansion of fiber-optic infrastructure. PON technology, which enables efficient data transmission over fiber-optic cables, has become a cornerstone in modern telecommunications. This article provides an in-depth analysis of the PON equipment market, covering market overview, key segments, recent industry developments, leading companies, market drivers, and regional insights.

Market Overview

As per MRFR analysis, the Passive Optical Network PON Equipment Market Size was estimated at 16.28 (USD Billion) in 2023. The Passive Optical Network PON Equipment Market Industry is expected to grow from 17.87(USD Billion) in 2024 to 50.0 (USD Billion) by 2035.. This growth is attributed to the rising demand for bandwidth-intensive applications such as streaming services, online gaming, and cloud computing, which necessitate faster and more reliable broadband connections. PON technologies, known for delivering high data rates and low latency, are well-positioned to meet this growing need for seamless connectivity.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/43004

Key Market Segments

The PON equipment market is segmented based on structure, component, and application:

By Structure:

Gigabit Passive Optical Network (GPON): Offers high bandwidth and is widely adopted for fiber-to-the-home (FTTH) deployments.

Ethernet Passive Optical Network (EPON): Utilizes Ethernet protocols, making it suitable for various data services.

Wavelength Division Multiplexing Passive Optical Network (WDM-PON): Employs multiple wavelengths to increase data transmission capacity.

By Component:

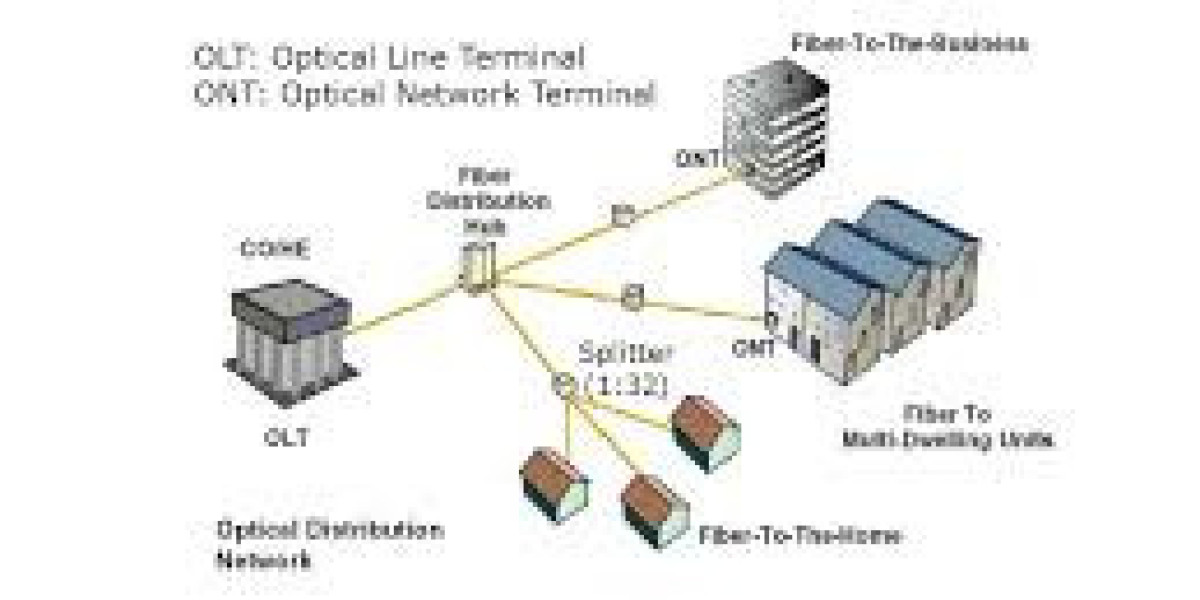

Optical Line Terminal (OLT): Central device located at the service provider's facility, managing data transmission to multiple endpoints.

Optical Network Terminal (ONT): Customer-premises equipment that connects end-users to the PON.

Optical Distribution Network (ODN): Comprises optical fibers and splitters that distribute signals from the OLT to ONTs.

By Application:

Fiber to the x (FTTx): Encompasses various fiber deployment configurations, including FTTH (home), FTTB (building), and FTTP (premises).

Mobile Backhaul: Supports the connection between cellular base stations and the core network, essential for mobile data services.

Industry Latest News

Recent developments in the PON equipment market highlight the industry's dynamic nature:

Nokia's Acquisition of Infinera: In February 2025, Nokia received unconditional EU approval for its $2.3 billion acquisition of Infinera, a U.S.-based optical semiconductors and networking equipment maker. This strategic move positions Nokia as the second-largest vendor in the optical networking market with a 20% share, following Huawei. The acquisition enables Nokia to expand its equipment sales to major tech firms like Amazon, Alphabet, and Microsoft, which are heavily investing in new data centers driven by the artificial intelligence boom.

Advancements in Optical Technologies: In March 2025, Nokia unveiled 25G PON fiber modems, marking a significant advancement in optical technologies. This launch aims to make large-scale multi-gig and 10G+ modems viable and affordable, catering to the growing demand for high-speed internet services.

AI Networking Developments: The rise of artificial intelligence (AI) has significantly boosted the stocks of companies supplying the necessary network technology to support large-scale AI systems. Companies like Nvidia, Broadcom, Cisco, and Arista Networks are thriving as they provide the network chips, lasers, and switches needed to integrate thousands of processors into single AI systems, crucial for data center operations.

Key Companies

Several companies play pivotal roles in the PON equipment market:

Nokia: A global leader in telecommunications, Nokia's recent acquisition of Infinera enhances its position in the optical networking sector.

Huawei: Holding the largest market share in optical networking, Huawei continues to innovate in PON technologies.

ZTE Corporation: Offers a comprehensive range of PON solutions and has a strong presence in emerging markets.

Cisco Systems: Provides advanced networking solutions, including PON equipment, catering to both enterprise and service provider markets.

Calix: Specializes in access networking technologies and has been instrumental in advancing PON deployments.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/passive-optical-network-equipment-market-43004

Market Drivers

Several factors are propelling the growth of the PON equipment market:

Increasing Demand for High-Speed Internet: The proliferation of bandwidth-intensive applications necessitates faster and more reliable internet connections, driving the adoption of PON technologies.

Expansion of Fiber-Optic Infrastructure: Governments and private enterprises are investing heavily in fiber-optic networks to support next-generation communication services.

Adoption of 5G Networks: PON provides a cost-effective solution for mobile backhaul, essential for the widespread deployment of 5G services.

Cost Efficiency: PON architectures reduce operational costs by eliminating the need for active electronic components between the central office and customer premises.

Regional Insights

The adoption and growth of PON equipment vary across regions:

Asia-Pacific: This region leads in PON deployments, driven by countries like China, Japan, and South Korea. High population density and government initiatives to enhance broadband connectivity contribute to this growth.

North America: The demand for high-speed internet and the rollout of 5G networks have spurred PON adoption. Investments in fiber-optic infrastructure are expected to continue, supporting market growth.

Europe: European countries are investing in fiber-to-the-home (FTTH) projects to meet the increasing demand for high-speed internet, boosting the PON equipment market.

Latin America and Middle East & Africa: These regions are gradually adopting PON technologies, with investments in telecommunications infrastructure to support economic development.